- #Credit card checksum serial number#

- #Credit card checksum generator#

- #Credit card checksum software#

Therefore we take no responsibility of misuse of this software. Credit card numbers made It is solely developed for educational and helping purpose. This formula has been in use to validate a lot of identification numbers besides Credit Card With Addresss since its development by scientist Hans Peter Luhn from IBM. The other digits are generally used to identify the card company, the financial institution.

#Credit card checksum generator#

All Credit Card With Address numbers generated via this Credit Card With Address generator can be validated by MOD 10 algorithm The MOD 10 algorithm is a checksum (detection of errors) formula which is the common name for the Luhn algorithm. In this method, the last digit of the card number is a checksum.

#Credit card checksum software#

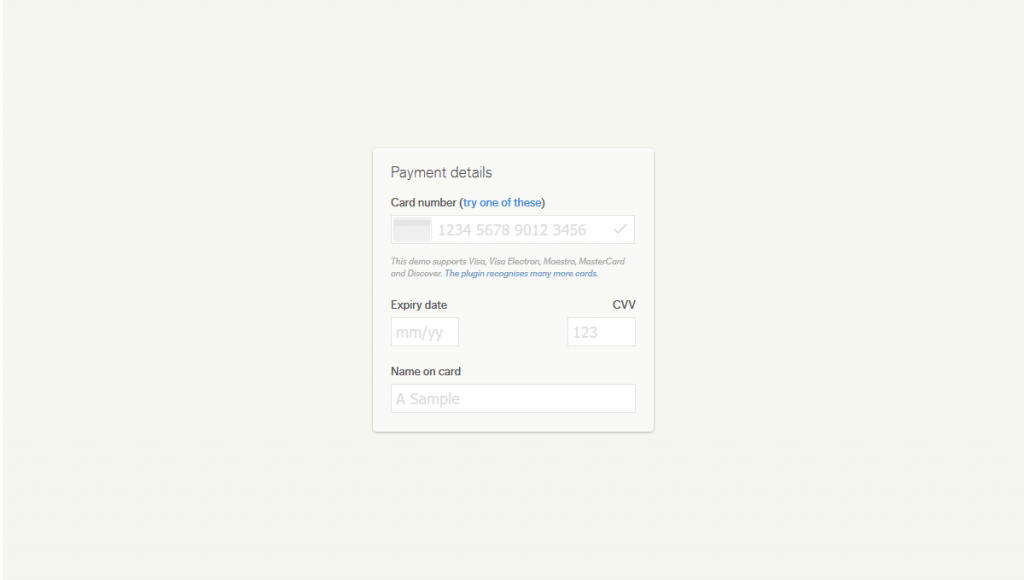

Our main intention is to help testing in ecommerce websites, in validating fields where a valid Credit Card With Address numbers are required and in various software applications. This Credit Card With Address generator right now generates Master card, Visa card, American express with cvv and expiration date, which can be used online for testing purposes. It is our suggestion that with Masking Credit Card component one should not process erroneous data without further analysis at all.Credit Card Generator With Cvv is a online utility WebApp that generates Credit Card With Address numbers that can be used anywhere for testing purpose. The Masking Credit Card components errors are the only ones not recommended for further processing as it is truly hard to break their format.ġ1. It is recommended that one re-directs the output into the error destination, so that later one be able to analyze and process data for quality purposes. To tell the difference between a credit card number and a harmless 16-digit string, a calculation is performed (checksum) to confirm that the numbers match a known pattern from the various.

#Credit card checksum serial number#

As the connection is made, one needs to configure the state of failure: “Fail”,”Ignore” or “Redirect”.ġ0. Any 16-digit string isn't necessarily a credit card number, it could be a ticket number from a help desk system, or a serial number of a piece of hardware. One needs to create error destination connection and connect red arrow (error handling constraint) with this destination. To handle invalid values, each data masking component has error handling precedence constraint.

Invalid values are those that are not conforming to the rules of the entity. If, however, there are invalid values in the package's source, one would need to configure error handling. You can run the package with the Credit Card Data Masking component, and see the results of data masking:ĩ. Now, all the configurations are complete for the valid values. For that, just click on the available input columns, choose the masked value, and map to the “Available Destination Columns”Ĩ. In the connection manager, in the tab “Mappings”, specify that you want newly created Field_Masked to be a field replacing the original value. Create a connection manager for the destination and configure source component for the destination. This will create an extra column with the prefix “Masked_”.ħ. Now back in the old days before magnetic stripes, OCR and other means of automated data entry, yes I am sure they did. Please check-mark only one column, the one that you will be masking with Credit Card algorithm:Ħ. In the second tab, there are input columns. Now that the metadata for the Credit Card exists, and values are passed into the data masking component, please open the component editor:ĥ. If you click on constraint, you will see:Ĥ. Now, the precedence constraint (the blue arrow) passes proper meta-data to the MaskingCreditCard component. Drag and Drop Credit Card masking component, connect the source and the Credit Card component with the source's precedence constraint:ģ. The data in the column may also include any other character that will be treated as a separator.Ģ. Configure a source that contains the column with alphabetical and numeric characters. The length is in between 13 to 19 characters and contains only numbers and no space in between. It produces a card of the same issuer with the parity digit consistent with Luhn calculation.ġ. Make sure that the Credit Card or Debit Card Number follows the proper format. There might be separators in between the digits, such as “-“or “/”. The Masking Credit Card component expects a credit card number in a string that consists of integers, e.g.: XXXXXXXXXXXXXXX.

Variation of Random Algorithm Description For example, Visa card number will always transform into another Visa card number. The purpose of the component is to randomly mask credit card values retaining card issuer as is and checksum last digit confirming to the Luhn algorithm. CLR Reference (links) Usage Instructions: Purpose

0 kommentar(er)

0 kommentar(er)